The Federal Government has reaffirmed its commitment to restoring macroeconomic stability, aiming to bring Nigeria’s inflation rate down to single digits while targeting a seven percent economic growth rate.

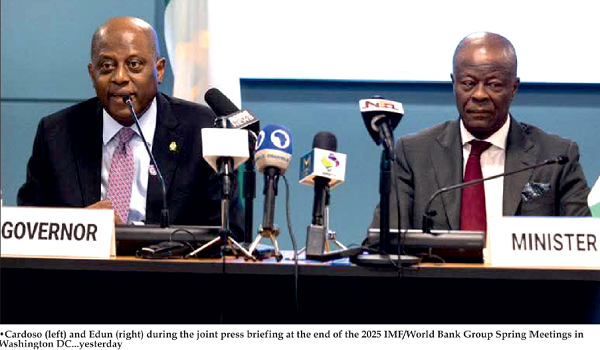

This was disclosed by the Minister of Finance and Co-ordinating Minister for the Economy, Wale Edun, and the Central Bank Governor, Olayemi Cardoso, during a joint press conference at the conclusion of the 2025 Spring Meetings of the International Monetary Fund (IMF) and the World Bank Group in Washington DC.

According to the National Bureau of Statistics (NBS), Nigeria’s inflation climbed to 24.23 percent in March, up from 23.18 percent recorded in February 2025. Recognising the challenge, Cardoso said:

“We recognise that inflation remains the most disruptive force to the economic welfare of Nigerians. Our policy stance is firmly focused on bringing inflation down to single digit in a sustainable manner over the medium term.”

He explained that the Central Bank’s objective is to “restore price stability, protect household purchasing power, and lay the foundation for long-term investment.”

Cardoso noted that Nigeria’s recent upgrade by Fitch Ratings, which praised reforms such as the exchange rate unification, deployment of an electronic FX matching platform, and tighter monetary policy, was evidence that the government’s economic strategies were yielding positive outcomes.

Setting an ambitious target, Edun said the government was working towards a seven percent growth rate for the economy, a move expected to substantially reduce poverty and improve living standards.

“That’s a commitment and target, and the way to get it is by focusing on agriculture, increasing productivity, as well as making food more available to the people,” he said.

He added that infrastructure development, particularly in the digital economy, and improved access to finance for businesses were among the government’s priorities. According to him, President Bola Tinubu remains determined to ensure that the benefits of ongoing economic reforms extend to the poor and vulnerable.

Speaking on social security measures, Edun revealed that the government had revamped its direct benefit transfer programme:

“It started off and it wasn’t robust enough or up to standard, so we stopped it. We are back to the drawing board, and now have a standard that requires payments going out to people on the social register, and allow each person to be identified biometrically, through a National Identity Number.”

Currently, 20 million Nigerians are captured in the social register, with the plan to add three million more each month going forward.

Reflecting on the broader global economic environment, Edun described the spring meetings as timely, given the prevailing global uncertainty, elevated interest rates, and high debt levels, especially affecting Sub-Saharan Africa.

He said domestic policies must be recalibrated to tackle the external shocks, noting:

“Fiscal policies should safeguard sustainability and rebuild buffers; remain investment friendly to create job opportunities and enhance resilient growth.

Policy calibration should be toward further restoring confidence and stability, reducing imbalances and improving productivity to drive sustainable growth. Regional and cross-regional economic integration and cooperation is critical.”

Reaffirming Nigeria’s economic direction under the Renewed Hope Agenda, Edun highlighted ongoing efforts in agriculture, road and rail infrastructure, social security, and major reforms in the oil and gas sector.

He disclosed that the Nigerian delegation held bilateral meetings with the President of the World Bank Group and IMF officials, where the global bodies expressed strong support for Nigeria’s reform efforts.

Additionally, high-level discussions were held with representatives from the U.S. State Department. According to Edun, the U.S. showed keen interest in Nigeria’s natural gas sector, particularly the Nigeria-Morocco Gas Pipeline project, alongside opportunities in infrastructure development, especially digital connectivity.

“Agriculture was identified as another strategic sector for collaboration, with the U.S. expressing interest in supporting Nigeria’s efforts to boost productivity, enhance value chains and strengthen food security through investment and technical cooperation,” he added.

Edun said Nigeria’s bold reforms had attracted international admiration, with the U.S. State Department describing the country’s recent economic achievements as “an economic miracle.”

He stressed the importance of fiscal consolidation and job creation as key drivers of poverty reduction, themes that resonated strongly throughout the spring meetings.

On the monetary front, Cardoso said the government’s adoption of a market-driven foreign exchange regime had enhanced transparency and restored investor confidence.

“We have embraced market-driven pricing for the naira, significantly enhancing transparency and restoring investor confidence.

Again, thanks to disciplined reforms and policy clarity, the naira has stabilised at a more sustainable level against the U.S. dollar.”

He noted that for the first time in Nigeria’s recent history, the gap between the official and parallel market rates had almost disappeared, with speculative arbitrage vanishing as a result.

Cardoso explained that the renewed stability had spurred autonomous inflows through formal channels, diversifying Nigeria’s foreign exchange sources beyond oil.

He further revealed that Nigeria’s external reserves had strengthened significantly:

“Our foreign reserves now exceed $38 billion, providing nearly 10 months of import cover. This robust buffer enables us to better withstand external shocks – whether from declining oil prices or global financial turbulence – thereby safeguarding our economy.”

Read also: FG opens national grid to private investors

The CBN Governor said Nigeria recorded a balance of payments surplus of $6.83 billion in 2024, driven by rising exports and renewed capital inflows, the strongest performance in many years.

He also provided updates on the ongoing banking sector recapitalization exercise, stating that it was progressing well with strong stakeholder alignment:

“At the same time, we are enhancing the strength of our financial sector. The banking sector recapitalization is well underway, with strong momentum and stakeholder alignment, and will ensure that Nigerian banks are fully equipped to support the real economy with greater scale, stability and capacity.”

Cardoso said feedback from global investors and the Nigerian diaspora had been overwhelmingly positive, as Nigeria is increasingly being recognised as a rising economic force.

“These achievements, while encouraging, only strengthen our resolve to press forward. We will not be complacent. Instead, we will redouble our efforts to ensure these positive trends are sustained,” he said.