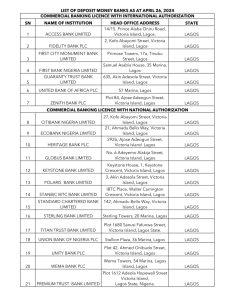

The Central Bank of Nigeria (CBN) has released a list comprising all licensed deposit money banks operating in the country.

Per the list, only 6 Nigerian banks are authorized to operate internationally. These include Access Bank, Fidelity Bank, First City Monument Bank, First Bank, Guaranty Trust Bank, United Bank for Africa, and Zenith Bank.

Additionally, the document indicates that there are 15 nationally authorized banks in the country. Notably, these include big names like Ecobank, Citibank, Wema bank, Heritage bank, Sterling bank, and Union Bank, among others.

Furthermore, the list also revealed the names of commercial banks with regional authorization, Non-Interest banks and merchant banks with national authorization, alongside financial holding companies.

Notably, the CBN’s publication follows a recent extension in cash deposit fee suspension.

CBN extends cash deposit fee suspension

The Central Bank of Nigeria (CBN) recently announced the extension of the Cash Deposit Processing Fee till September.

The apex bank in a May 6 letter addressed to banks and other financial institutions disclosed that the cash deposit fee has been extended further. Per the new statement, the extension will last until September 30, 2024.

“The Central Bank of Nigeria (CBN) hereby extends the suspension of the processing fees of 2% and 3% previously charged on all cash deposits above these thresholds until September 30, 2024.”

Recall that the CBN in December suspended processing charges imposed on certain cash deposits till April 30, 2024. These deposits include 500,000 for individuals and 3 million for Corporate Organizations. Following the end of the April 30 deadline, several banks resumed the deduction of the charges.

However, the CBN has now ordered all financial institutions to continue accepting the cash deposits without any charges until the new deadline.